4 min

20 Oct 25

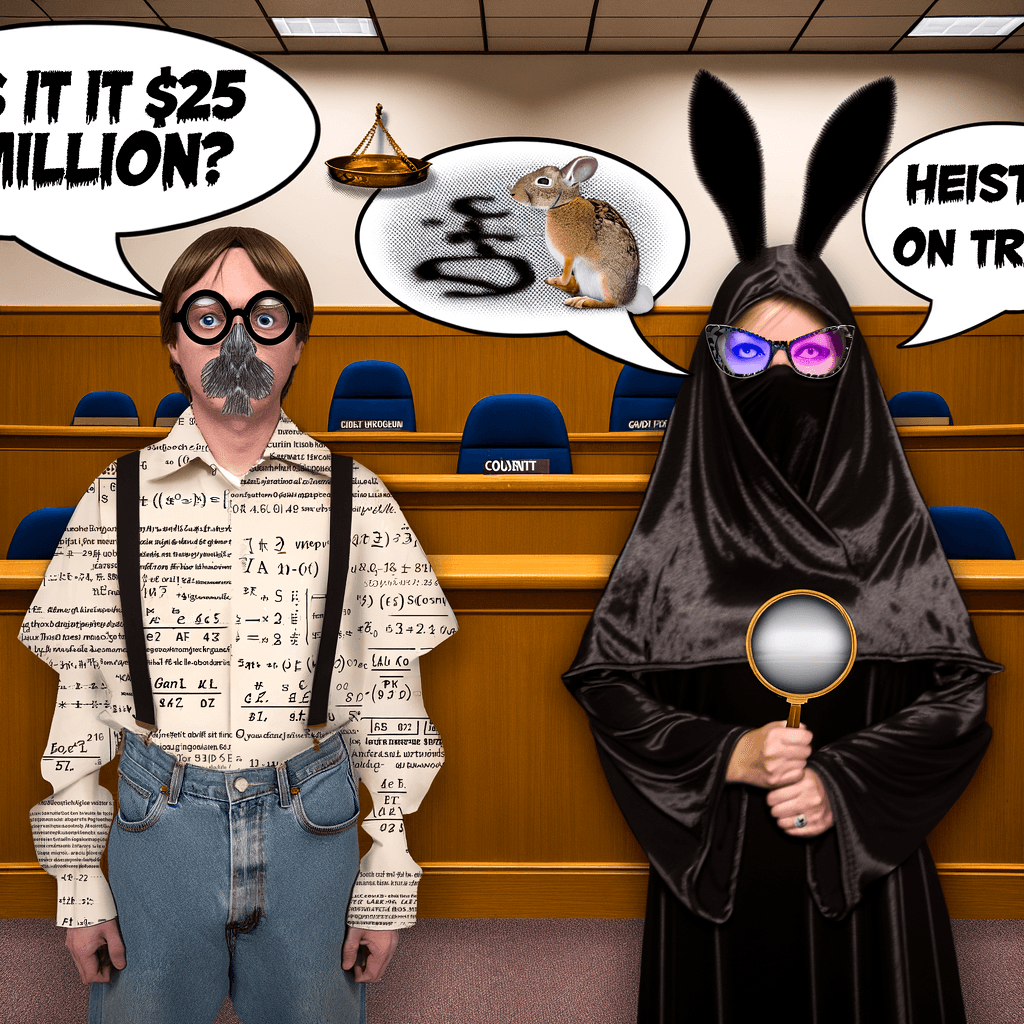

'True nerds' or crypto crooks? Meet brothers 'Snoopy' and 'Curious Rabbit,' on trial in a $25 million heist case.

Are the Peraire-Bueno Brothers Visionary Cryptocurrency Pioneers or Deceptive Fraudsters?

In the ever-evolving world of cryptocurrency, two MIT-educated brothers, Anton and James Peraire-Bueno, find themselves at the center of a legal showdown. Their defense attorneys champion them as brilliant innovators with advanced trading strategies, while federal prosecutors portray them as cunning tricksters who manipulated trading bots for personal gain. The outcome of this trial will hinge on whether their trading tactics were part of a legitimate business strategy or a nefarious ploy to defraud others in the crypto market.

The Background of the Brilliant Brothers

Before their names were entangled in legal proceedings, Anton and James Peraire-Bueno were known for their educational achievements. With degrees from the prestigious Massachusetts Institute of Technology (MIT), their academic prowess was evident. Anton, the younger of the two, graduated with a bachelor's degree in computer science and engineering, while James, the eldest, pursued mathematics combined with computer science and aerospace engineering, later obtaining a master’s in aeronautics and astronautics.

The Birth of a Cryptocurrency Empire

The brothers ventured into the cryptocurrency ecosystem in early 2021. Driven by a deep interest in coding and problem-solving, they began trading on the Ethereum network, a space they found intellectually stimulating and financially rewarding. Their fascination with crypto's innovative possibilities led them to establish a trading company called 18 Decimals. According to their defense, their trading strategies were legitimate attempts to navigate the competitive cryptocurrency markets.

The “Omakase” Trading Strategy

Central to the brothers’ defense is their unique trading method dubbed "omakase," named after a Japanese phrase meaning "I'll let you decide." This strategy, as described by their attorneys, was developed to counteract so-called “sandwich attacks” executed by automated trading bots. The brothers allegedly engaged in tactical discussions with other crypto enthusiasts to combat these predatory moves, which they regarded as detrimental to the crypto trading environment.

The Prosecutors’ Narrative: A Case of Manipulation

In stark contrast, the prosecution alleges that the brothers engaged in deceitful practices to defuse cryptocurrency market vulnerabilities for their own benefit. They describe a calculated maneuver — executed in a mere 12 seconds — which allegedly swindled $25 million from other traders. According to prosecutors, the two set up "bait transactions" to lure trading bots into a trap, wherein they manipulated the crypto prices to execute a profitable but deceptive trade, thus leaving their victims with significant monetary loss.

Defense vs. Prosecution: The Ethical and Legal Quandary

The defense insists that the brothers’ trading actions were transparent, evidenced by their subsequent tax payments on the earnings, totaling an impressive $6 million. This preemptive tax settlement is presented as a critical argument against malicious intent or concealment of funds. Their attorneys argue that submission to tax authorities demonstrates that the brothers believed their trades to be above board and compliant with existing regulations.

Conflicting Testimonies: Perceptions from Industry Observers

Robert Miller, an engineer directly associated with the Ethereum-related software used by the defendants, delivered mixed testimony. While acknowledging the brothers' technical ingenuity, Miller expressed disappointment in their decision to execute what he considered a reckless action which might irreparably harm their reputations and future prospects. This duality showcases the broader complexities of crypto trading ethics and software use.

The Broader Implications of the Trial

This trial underscores the ambiguity and challenges of regulatory enforcement within a rapidly evolving cryptocurrency market, sparking a broader discussion about the balance between innovation and market integrity. As the case unfolds, the jury’s verdict could set a precedent that influences future legal interpretations and regulatory frameworks around cryptocurrency trading tactics.

The Outcome Awaits

As Anton and James Peraire-Bueno face charges with severe implications, including up to 20 years of imprisonment for each count if convicted, the final decision of this courtroom drama will pivot on the jury’s interpretation of whether these individuals are crypto pioneers engaging in creative trading strategies or individuals who crossed ethical lines into fraud. The world waits eagerly for a verdict that could ripple through the future of cryptocurrency regulation and trading strategy legitimacy.